does colorado have an estate or inheritance tax

A qualified personal residence trust or QPRT can provide estate and gift tax savings but they also can be complicated to set up and maintain May 02 2022 3 min read Estate Planning. This includes federal and state income taxes as well as any federal estate taxes and state estate taxes.

Here S Which States Collect Zero Estate Or Inheritance Taxes

There is no obligation.

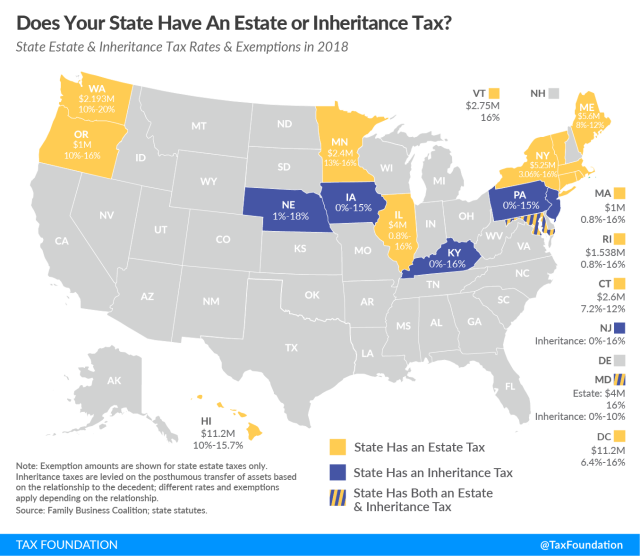

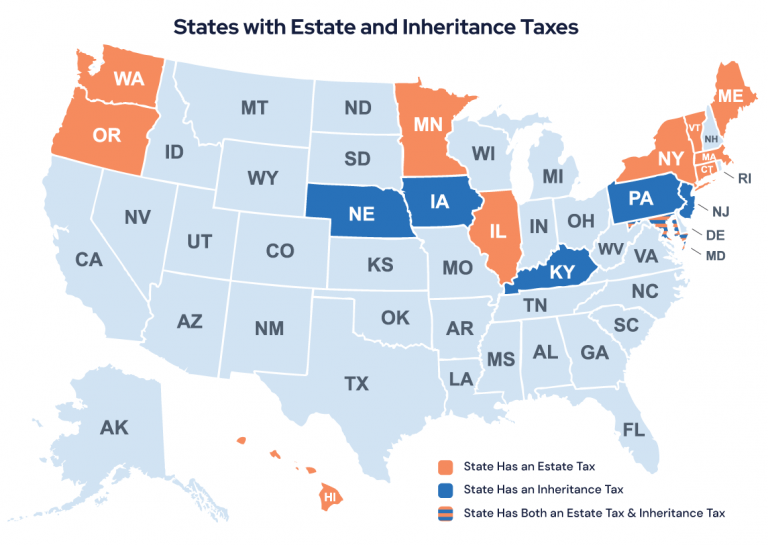

. If the estate has real estate in multiple states you may have to go through separate probate processes which may or may not delay the distribution of assets. The tax burden that your estate has is another factor that could prolong the probate. Twelve states and Washington DC.

Beneficiaries and heirs will pay any federal or state impose inheritance tax once their inheritance is disbursed. Although both taxes are often lumped together as death taxes Twelve states and the District of Columbia have estate taxes as of 2022 but only six states have an inheritance tax Maryland has both taxes. The United States tax code and each states estate andor inheritance taxes can be a confusing arena to navigate on your own.

These documents include but are not limited to the following. When it comes to May 02 2022 3 min read. Thats an estate tax.

If your probate case does not pay then you owe us nothing. The Personal Representative and the estate attorney will need to locate and produce documentation that will be needed for the estate inventory inheritance tax return and the estate Account. When considering these local taxes the average Colorado sales tax rate is 772.

This is particularly true if you have to deal with estate taxes. The states property tax rates are among the nations lowest with an average effective rate of just 049. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you.

Impose estate taxes and six impose inheritance taxes. Your credit history does not matter and there are no hidden fees. Documents Needed For Proper Estate Administration in PA.

Maryland is the only state to impose both. The inheritance tax is not based on the overall value of the estate. During this time the executor will also file the final tax return for the estate and pay any taxes owed.

You can use the advance for anything you need and we take all the risk. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. As I previously mentioned there is no inheritance tax in California.

Sometimes the estate tax is called the death tax At the federal level the estate tax only applies to large estates regardless of which state you live in. Estate taxes vary from state to state. The California Inheritance Tax and Gift Tax.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. On the other hand homeowners in Colorado get a break on real estate taxes.

Don T Die In Nebraska How The County Inheritance Tax Works

State Estate And Inheritance Taxes Itep

Here S Which States Collect Zero Estate Or Inheritance Taxes

Domicile What It Means How It Impacts Inheritance

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Canadian Tax On Inheritance From The Us

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Colorado Estate Tax Everything You Need To Know Smartasset

A New Tax Study Should Freak Out Billionaires

State Estate And Inheritance Taxes Itep

2 229 Inheritance Tax Stock Photos Pictures Royalty Free Images Istock

State Taxes For Retirees Social Security Pensions Military

Inheriting A House In Colorado Things To Know Beforehand

Colorado Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)